are union dues tax deductible in nj

If you and your spouse are filing jointly and. Employee union dues are no longer deductible in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act.

31 2020 and has not been renewed for 2021.

. PENSION AND UNION DUES NJEA. Prior to 2018 an employee who paid union dues prior may have been able to deduct them as unreimbursed employee business expenses if the total of the dues plus certain miscellaneous itemized expenses reached a certain level. Enter all your medical expenses in the federal interview other than health insurance as NJ has a different cap than the fed.

In Abood the Court held that a public employee could still be required to pay union dues to cover collective bargaining contract administration and grievances even if they refused to join the union. Include your union dues along with other union fees under miscellaneous deductions These deductions become allowable when they exceed the threshold of 2 percent of your adjusted gross income. Credit Union-Deduction from first and second pays.

But if you took the itemized deduction NJ taxes health insurance premiums so they can be itemized in your NJ return as additional deductions. Excess contributions that you withdraw before the due date of. Labor Day 2018 doesnt bring much good news for unions.

Monday September 03 2018. NJ requires you to take standard deduction if you did so federally. With this new state tax benefit in effect it is projected to give back approximately 35 million to union members throughout New York State.

Because of the recent Supreme Court ruling in Janus v. Union dues no longer deductible under new tax law. About the 2022 budget.

To put this in more simplified terms. NJ medical expense deduction is at 4 of AGI cap. The bill the House passed would allow union members to deduct up to 250 of dues from their tax bills.

The employee then deducted the dues if the employee was able to itemize deductions. It allowed you to deduct what you spent on union dues along with other job-related expenses if you itemized your deductions on your tax return rather than take the standard deduction. UNION DUES CANNOT BE DEDUCTED FROM GOVERNMENT EMPLOYEES IN New Jersey WITHOUT CONSENT.

Before 2017 union dues were a work-related expense that could be included in an itemized below-the-line deduction of expenses exceeding 2 of the employees adjusted gross income. You can claim dues related to your employment paid by you or paid on your behalf that were included as part of your income during the year. The dues for persons eligible for active professional or active supportive membership who are on an approved unpaid leave of absence shall be one-half of the full dues for their respective membership category.

Tax Deduction of Your TALB Dues. As a result of the Tax Cuts and Jobs Act TCJA that Congress passed and was signed into law on December 22 2017 employees can no longer deduct union dues from their federal income tax in years 2018-2025. Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union dues too.

Effective in 2019 union members can NOW deduct their union dues from state taxes provided they itemize deductions. The deduction was up to 4000 above the line but barring new legislation it is no longer available. In 2017 tax law only allowed union dues to be deducted as an unreimbursed business expense.

Yearly union dues when youre a member of a. NJ Education Association Dues-Once a month deduction from first paycheck. There are various types of union dues and professional membership dues you can deduct when filing your taxes.

5 This meant that 1 only the portion of union dues plus any other unreimbursed business expenses. AFSCME government workers are no longer forced to give part of each paycheck to highly political government unions as a condition of working in public service. The Tuition and Fees Education Tax Deduction expired on Dec.

Only unreimbursed expenses for books supplies and equipment that you purchased for classroom use qualify for the 250 Educator Expense deduction. Full Dues for Union Membership-deduction from first and second pays. Politicians and the public tend to view them unfavorably.

Eligible educators can deduct up to 250 of qualified expenses you paid in 2020. The employee could only opt out of paying a portion of fees. As a statutory officer of the State of New Jersey the Tax Collector is obligated to follow all the State Statutes regarding property tax collection including billing due dates interest on delinquent tax payments reporting and tax.

The Supreme Courts ruling. The union dues deduction was alive and well through the end of the 2017 tax year. Be sure to express the percentage of use in decimal form for example 30 should be written as 30.

The TCJA made union dues non-tax deductible Prior to 2018 an employee who paid union dues may have been able to deduct unreimbursed employee business expenses including union dues. And they lost a tax break in last years tax reform bill. No employees cant take a union dues deduction on their return.

Simply tally the total amount of your phone or internet bill for the year and determine the overall percentage of use that went toward doing things like updating your website gathering research materials or making business calls. A reminder for tax season. Educator expense tax deduction renewed for 2020 tax returns.

Detroit Board of Education a prior United States Supreme Court case from 1977. New Jersey follows the federal rules for deducting qualified Archer MSA contributions. Please note that tax payers can now itemize deductions on state taxes even if they do not itemize on federal taxes.

However with the introduction of new tax reforms unreimbursed employee expense deductions have been eliminated. The CRA lets you claim the following types of dues on your tax return. Your contribution cannot be more than 75 of your annual health plan deductible 65 if you have a self-only plan.

The first step is to include your union payments as income on your tax return. Republicans removed most work-related itemized deductions in the 2017 Tax Cuts and Jobs Act TCJA. The deduction is above the line meaning filers can exclude the cost of dues from their.

Prior to the Act they were partially deductible as a miscellaneous. This is a credit so its taken off your tax liability. The Tax Office collects all tax money owed by Union property owners for municipal county and school taxes.

Union dues may be deductible from California income taxes if you qualify to itemize on your California tax. Prior to the 2018 tax year workers were able to deduct union dues check-offs. The Lifetime Learning Credit is for 20 of education expenses up to 10000 or a maximum credit of 2000.

Membership in the workplace organizations has at best stalled.

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

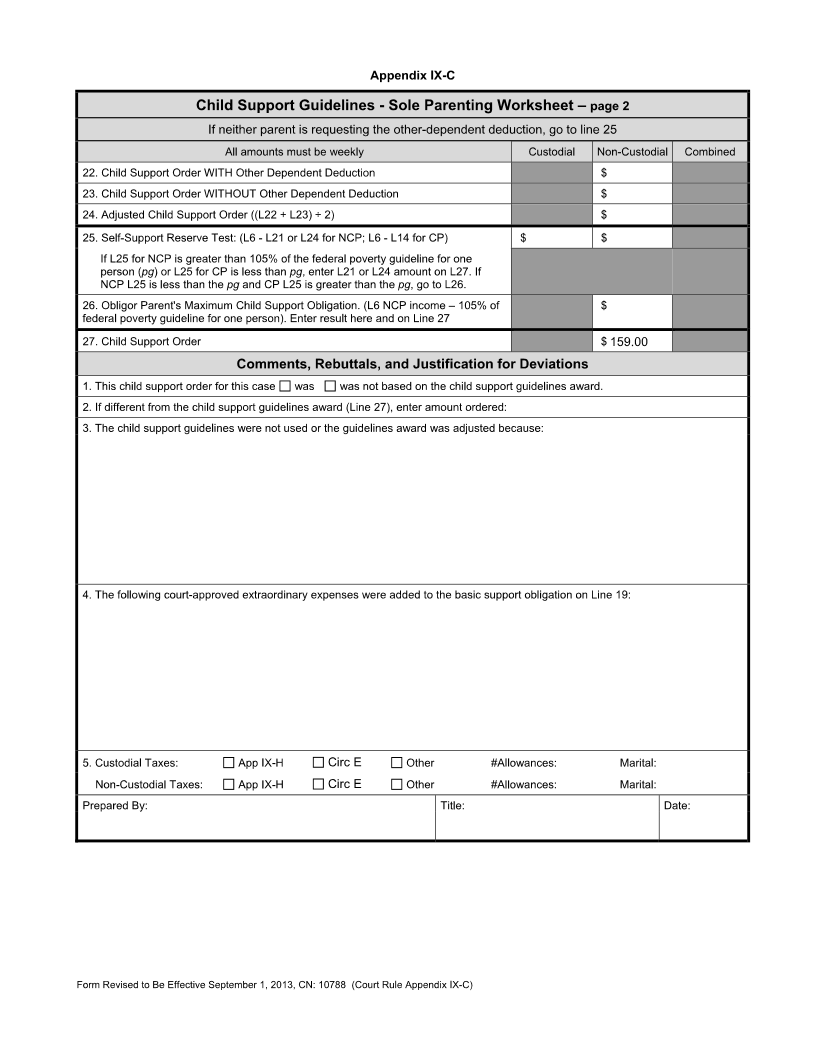

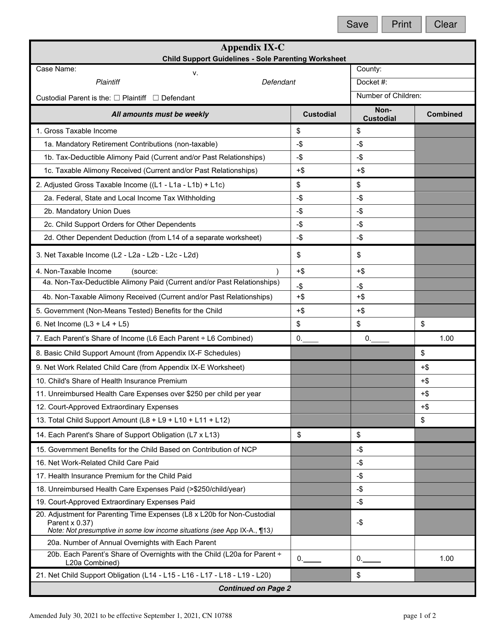

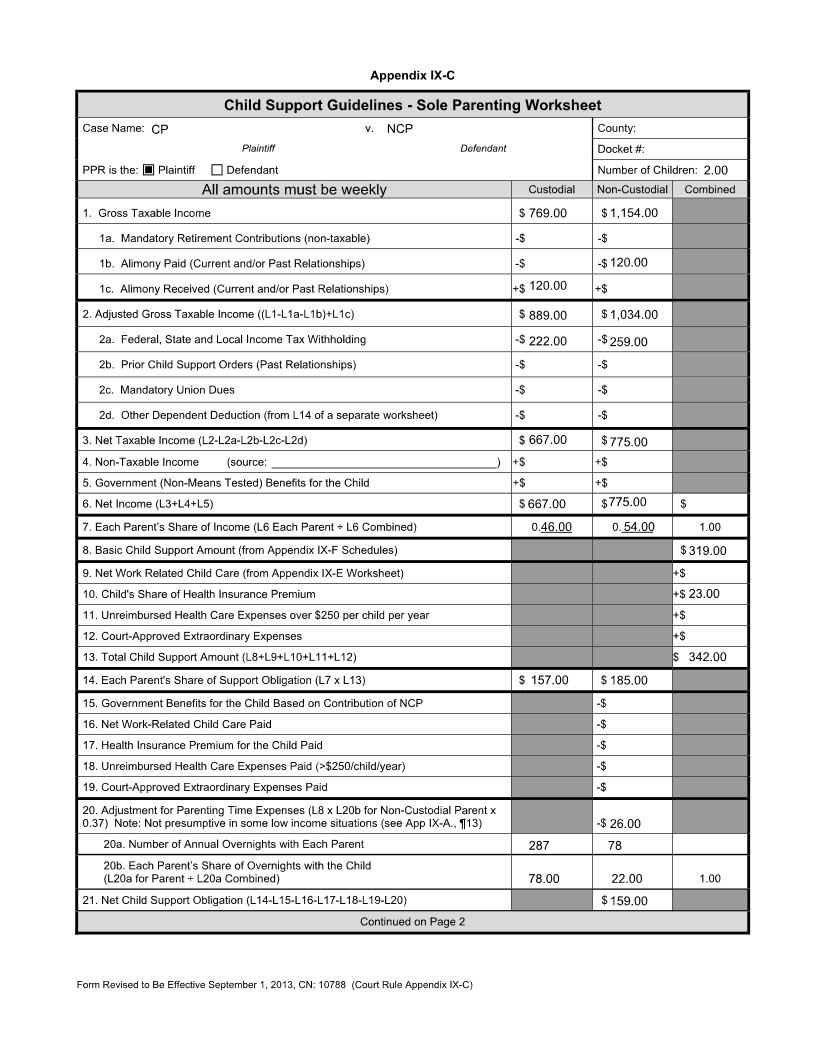

How Much Child Support Will I Pay In New Jersey

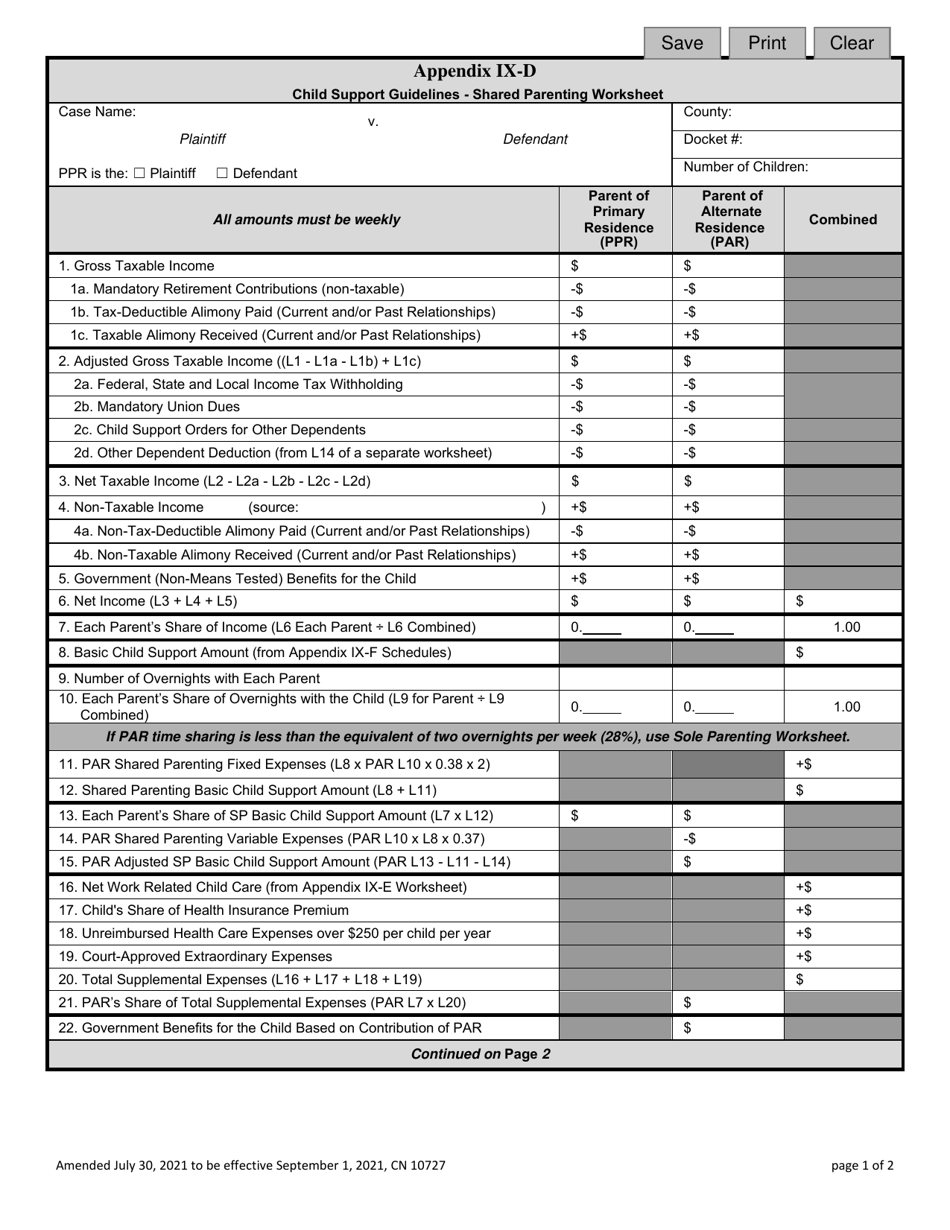

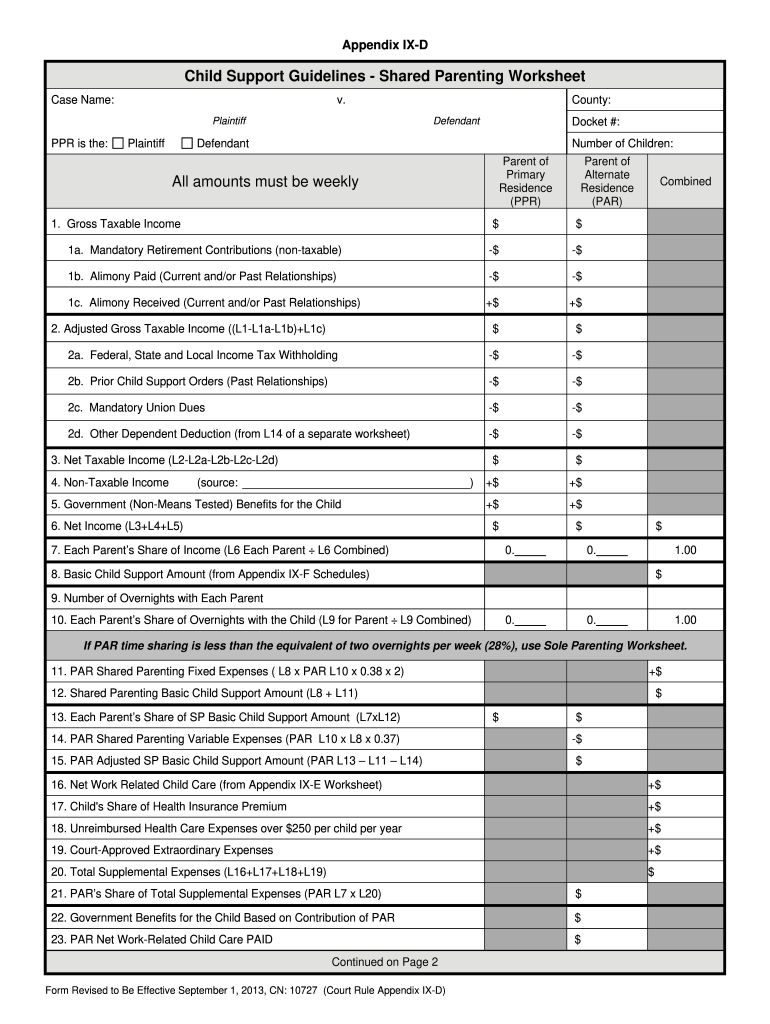

Form 10727 Appendix Ix D Download Fillable Pdf Or Fill Online Child Support Guidelines Shared Parenting Worksheet New Jersey Templateroller

Can A Butcher Claim Meat Shrinkage And Spoilage As A Tax Deduction Quora

Form 10788 Appendix Ix C Download Fillable Pdf Or Fill Online Child Support Guidelines Sole Parenting Worksheet New Jersey Templateroller

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Nj Child Support Guidelines Shared Parenting Worksheet 2013 2022 Complete Legal Document Online Us Legal Forms

How Much Child Support Will I Pay In New Jersey

Union Dues Are Now Tax Deductible Foa Law

Union Fees Are They Tax Deductible And What Are They Pop Business

Membership Dues Tax Deduction Info Teachers Association Of Long Beach